"CurveBlock is working to pioneer Financial Inclusion (The Shared Economy) within the real estate development sector. The goal is for you to profit each time we build and sell a carbon zero, energy positive development. We aim to make the public the FINANCIERS & BENEFICIARIES of the sector by sharing all future profits evenly, INNOVATION is the only solution to a better world." CurveBlock: Financial, Social, Environmental & Sustainable Impact.

Collaborations

What People Are Saying

Legal

We strive to comply with all legal and regulatory requirements in all jurisdictions to ensure safety and reduce risks for all parties.

Return

“Buying real estate is not only the best way, the quickest way, the safest way, but the only way to become wealthy.” - Marshall Field, entrepreneur

Borderless

CurveBlock aims to work with regulators so we can allow investments from just about anywhere.

WHAT ARE WE DOING AND WHY ARE WE DOING IT?

Our customers have a problem of financial exclusion, being locked out by regulators not allowing them to participate. They are also limited by either a lack of time, lack of money, lack of investment knowledge or all three of these problems.

We look to solve this problem by working with the regulators to change the existing regulations and opening the doors to allow regular people to participate. Once proper regulation is in place, we aim to use the CurveBlock platform to let people participate in the real estate development space with as little as £10, until then, we will fund all developments privately and not with the publics money. We plan for onboarding to only take around five minutes. Using the CurveBlock platform you will never have to study and select a development opportunity as the best opportunities are brought into the fund by experts on our team.

If changing regulations to allow you access isn’t enough, our platform gives you the rights to a share of the profits we make from everything our platform builds & sells, as long as you remain invested.

The market we’re entering is the world’s largest asset class currently valued at $268T.

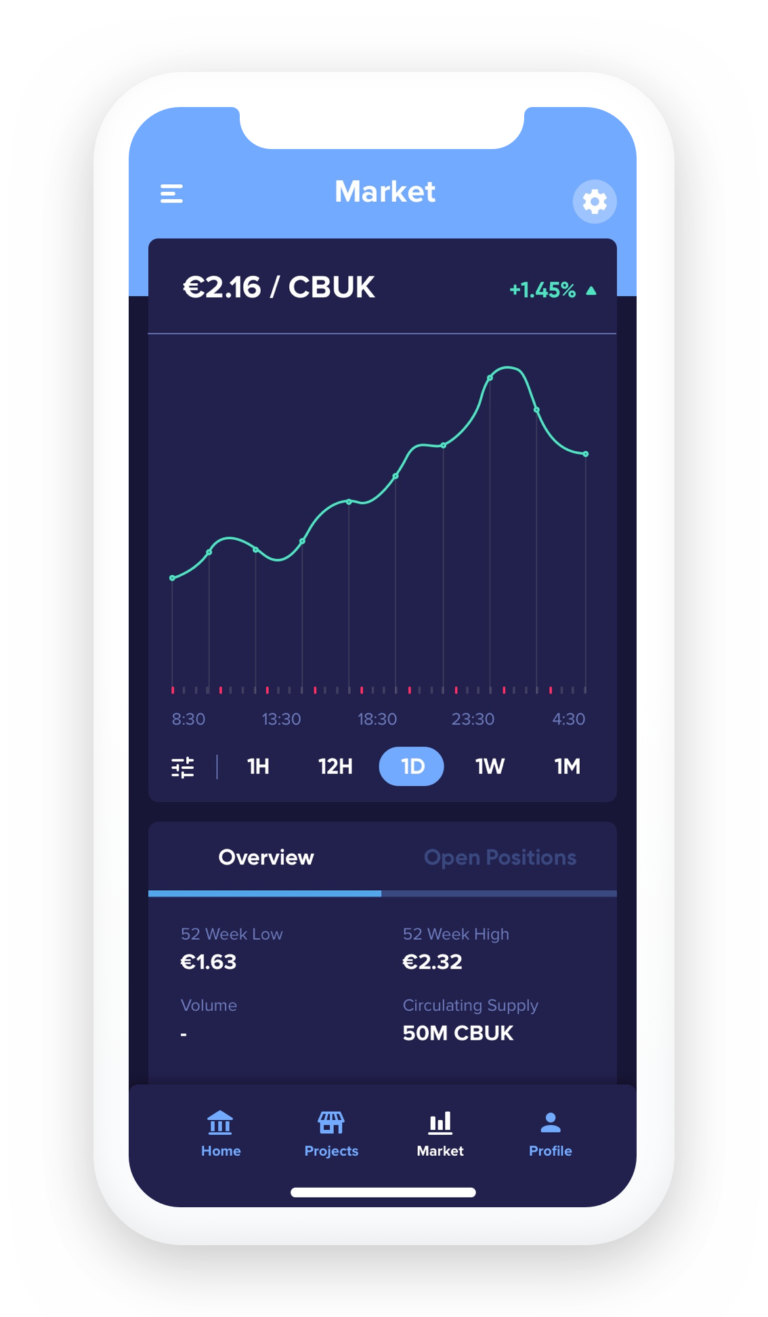

Real Estate Investments Using Blockchain.

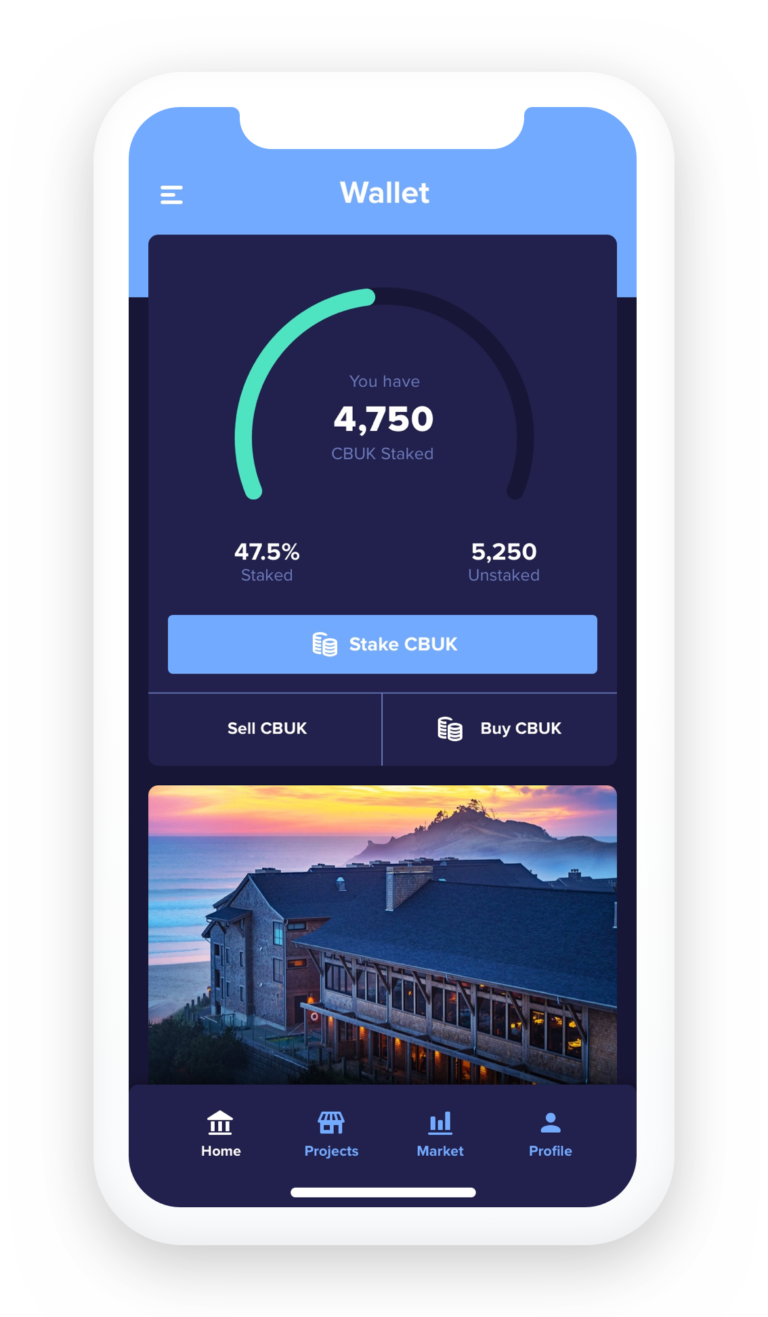

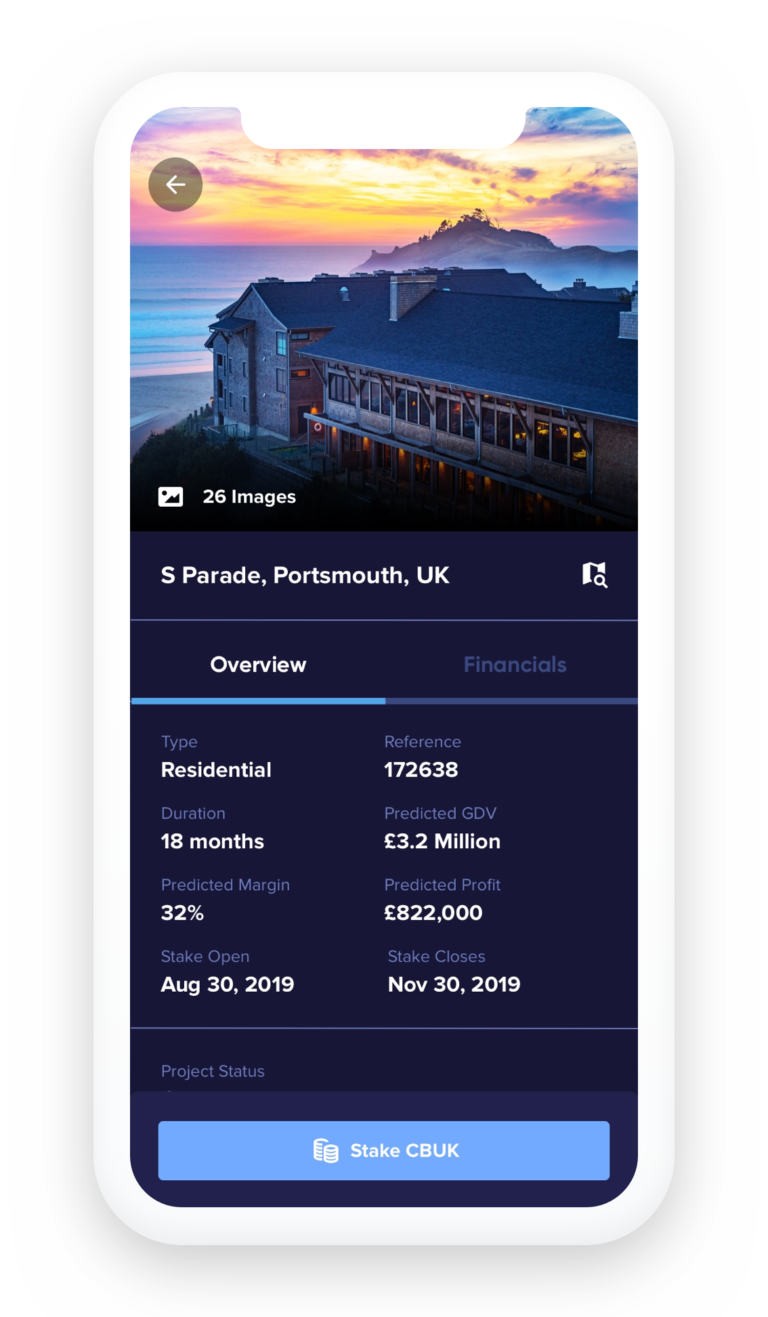

- CurveBlock looks to work with the FCA to become a Centralised Secondary Exchange which allows shareholders to stake their shares against carbon zero, energy positive Real Estate Developments for a share of the profits once built and sold.

- Profits (revenue) are proposed to be paid via GBP and allow you, the investor, to decide if you would like to reinvest or take your profits.

- Once regulation is achieved, your digital shares could stay invested against all developments for continued passive income. The CurveBlock exchange looks to offer liquidity should you need to cash out.

- CurveBlock looks to provide a smart contract staking wallet, powered by Blockchain with all assets held in custody outside the CurveBlock ecosystem.

- CurveBlock won’t be wasting money to get listed on other exchanges once regulated, removing the risk of market manipulators damaging the value of your shares via questionable trading activities.

- 5% of every Development will be donated to CurveBlock Helps our nonprofit charity, and the recipients of the assistance will be chosen by you.

- Each digital share is proposed to include charity and project voting rights

- CurveBlock looks to develop all sites using modern methods of construction for efficiency and reduced carbon in construction.

- All developments look to be carbon zero, energy positive residential developments with each home or lodge producing more energy than it consumes.

- CurveBlock aims to be a recession proof model, so no matter what the market conditions are you still receive your profits (dividends).

Roadmap

2018

- Q3 CurveBlock incorporated

- Q3 Accepted into SetsSquared partnership accelerator

- Q4 Seed Funding

2019

- Q1 – Q4 Seed Funding

- Q2 NatWest Bank accelerator, first STO accelerated by commercial bank in UK

- Q2 Regional Finalist in Startup of the Year with Great British Entrepreneur Awards

- Q3 CurveBlock Prototype Released

- Q3 Developments Launched

- Q3 CB admitted to Season 2 of NatWest Accelerator

- Q3 CB asked to mentor Season 1 of NatWest Accelerator

- Q3 Onboarded into Tech Nation Founders Network

- Q4 CB invited into CMS equIP scale-up programme

- Q4 Property Development Projects Commence (UK)

2020

- Q2 CurveBlock name Trademarked

- Q2 CurveBlocks first carbon zero, energy positive A+ EPC rated home development project agreed

- Q2 Accepted in to Founder Institute Silicon Valley (London Cohort)

- Q3 Current Token Holders all staked until Wallet is ready

- Q4 CurveBlock graduates Founders Institute

- Q4 CurveBlock nominated for Prestigious Innovator of the Year with British ExForces Business Awards

- Q4 Winner Sustainability Award with Lotus Awards

- CurveBlock represented at the Tokyo Paralympics

2021

- Q1 Joined Loyal VC’s portfolio

- Q1 Added into Founder Institute Select Portfolio (top 2% of grad’s)

- Q1 Venture Partnership announced with former NatWest Bank Director

- Q2 Accepted into Innovate Finance

- Q2 Renewable energy positive prototype house revealed

- Q2 Venture partnership announced with Omniflow

- CurveBlock nominated as 2022 Leeds Tech Climber

- CurveBlock Ventures trademarked to market our professional investor fund

- CurveBlock represented at the Tokyo Paralympics

2022

- CurveBlock Ventures trademarked

- CurveBlock Ventures Professional Investor Fund approved by FCA

- Property Development Projects Complete

- CurveBlock Technologies model Lodge built and installed

- Village Capital & IBM accept CurveBlock into their HPA and will mentor CurveBlock for 2 years

- Crowned winner Of Europe, U.K. & Ireland FinTech-4-Good Awards

- Commenced a £3m development in Chaldon Surrey

- Made top 50 fasting growing companies

- Announced Excelledia ventures technology partnership

- Tech climbers 2022 winner

- Made Leeds 10 fastest growing FinTech’s list

- CurveBlock listed in the world market research report

2023

- Matteo’s join CurveBlock

- FSA Japan invites CurveBlock to launch in Japan

- CurveBlock WINS – Best Real Estate Investment Solution UK

- Founders invited into the House of Lords

- CurveBlock in Barclays Rise accelerator

- CurveBlock partners with established development & consultancy Rasico

- Featured in The FinTech Times

- CurveBlock WINS – Late Summer show tournament

- CurveBlock attends 3 Political Party Conferences

- FCA regulation moves positively after extensive engagement

- Colonel Stephen Boardman MBE DL Partnership

- 5000sqft Energy Positive Home Move In

- Platform V1.0 LIVE

Forecast

2024

- Apple App onto Apple App Store – ready for deployment

- Android App onto Google Play Store – ready for deployment

- Consultation talks with FCA and BoE for DSS Cohort 1

- CTO Recruitment

- Enhance platform with social media user marketplace

- Offer platform as white-label product

- Create platform digital twins for growth outside UK

- ISO27001: Tec-Stack / Platform regulatory accreditation

- First investment project start to complete Q4

- Add additional investment projects to platform

- Hire new developer to integrate blockchain into platform

- Major Risk evaluation for DSS application Q3

- Apply for cohort 1 of DSS Q3

- Q4 working with FCA and BoE in DSS

- Q4 FCA regulatory application

2025

- Start onboarding regulated users

- Add 5 additional investment projects to platform

- BoE regulatory application

- Open UK office per FCA requirement Q1

- Recruit CFO

- Recruit compliance personnel

- Hire outside auditing firm and pass audit compliance

- Ongoing DSS compliance

- Q3 work with BoE for regulatory change and compliance

- Recruit CMO

- Monthly virtual board meetings

- Quarterly in person board meetings

2026

- Continue onboarding regulated users

- Add 10 additional investment projects to platform

- Q2 graduate from DSS

- Q3 Investor Meeting

- Q1 Recruit administrative personnel

- Q3 Hire outside blockchain auditor

- Ongoing compliance review

- Monthly virtual board meetings

- Quarterly in person board meetings

2027

- Continue onboarding regulated users

- Add 10 additional investment projects to platform

- Q3 Investor Meeting

- Ongoing compliance review

- Monthly virtual board meetings

- Quarterly in person board meetings

- Annual blockchain audit

- Annual accounting audit